All Categories

Featured

Table of Contents

Different plans have various optimum degrees for the amount you can spend, up to 100%., is added to the cash money value of the plan if the indexed account reveals gains (usually determined over a month).

This suggests $200 is added to the money value (4% 50% $10,000 = $200). If the index falls in worth or stays stable, the account webs little or absolutely nothing.

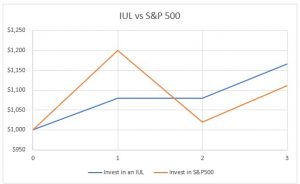

Having this suggests the existing cash money worth is shielded from losses in a poorly carrying out market. "If the index generates a unfavorable return, the client does not take part in an unfavorable attributing rate," Niefeld stated. In other words, the account will not shed its initial cash worth. The money value accumulates tax obligation deferred, and the survivor benefit is tax-free for beneficiaries.

Universal Life Insurance Premium Calculator

For instance, someone who establishes the plan over a time when the marketplace is carrying out poorly might end up with high premium settlements that do not add whatsoever to the cash value. The policy could after that potentially gap if the costs settlements aren't made promptly later on in life, which might negate the factor of life insurance policy altogether.

Boosts in the cash money worth are limited by the insurance firm. Insurer often establish optimal involvement rates of less than 100%. Furthermore, returns on equity (ROE) indexes are usually capped at specific amounts throughout great years. These limitations can limit the real price of return that's attributed towards your account yearly, no matter just how well the plan's underlying index carries out.

The insurance company makes money by keeping a portion of the gains, consisting of anything above the cap.

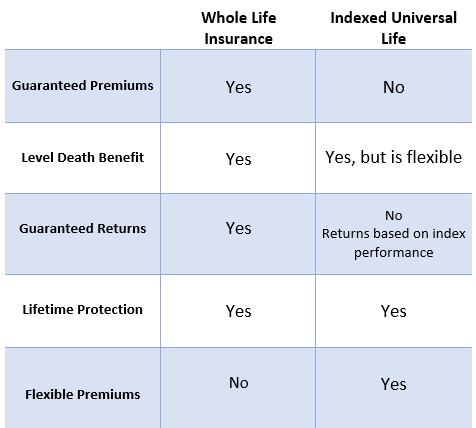

The capacity for a greater rate of return is one benefit to IUL insurance coverage compared to various other life insurance policy plans. Nevertheless, larger returns are not assured. Returns can actually be reduced than returns on other items, depending on how the market carries out. Insurance holders have to accept that danger for possibly greater returns.

In case of plan cancellation, gains come to be taxed as income. Losses are not deductible. Charges are commonly front-loaded and built into complex crediting price estimations, which might confuse some investors. Charges can be high. Costs vary from one insurer to the following and depend upon the age and wellness of the insured.

Terminating or giving up a plan can lead to more costs. Pros Offer higher returns than various other life insurance coverage policies Permits tax-free funding gains IUL does not reduce Social Protection benefits Plans can be designed around your danger appetite Cons Returns covered at a particular level No assured returns IUL might have greater charges than various other policies Unlike various other types of life insurance policy, the worth of an IUL insurance coverage plan is linked to an index connected to the supply market.

Equity Indexed Universal

There are numerous other kinds of life insurance policy plans, discussed below. Term life insurance policy provides a fixed advantage if the policyholder passes away within a set time period, normally 10 to three decades. This is just one of the most cost effective sorts of life insurance, along with the easiest, though there's no cash money worth buildup.

The plan acquires value according to a fixed routine, and there are fewer charges than an IUL insurance coverage policy. Variable life insurance coverage comes with also more versatility than IUL insurance policy, implying that it is also extra complicated.

An IUL plan can provide you with the very same kind of coverage security that a irreversible life insurance policy plan does. Remember, this sort of insurance policy stays undamaged throughout your whole life much like other long-term life insurance coverage plans. It additionally allows you to develop cash money value as you age through a securities market index account.

Allianz Iul

Keep in mind, however, that if there's anything you're unclear of or you're on the fencing regarding obtaining any type of insurance, make sure to get in touch with a professional. By doing this you'll know if it's budget friendly and whether it suits your monetary strategy. The cost of an indexed global life plan relies on numerous elements.

Nonetheless, you will lose the survivor benefit called in the policy. Indexed global life insurance coverage and 401(k) prepares all have their own benefits. A 401(k) has even more financial investment options to pick from and may include a company suit. On the various other hand, an IUL features a death advantage and an additional cash value that the insurance policy holder can obtain versus.

Indexed global life insurance policy can help you fulfill your family members's needs for economic security while also constructing cash money worth. Nonetheless, these policies can be much more complex contrasted to other kinds of life insurance, and they aren't always right for every capitalist. Speaking with a skilled life insurance policy representative or broker can assist you determine if indexed global life insurance policy is an excellent fit for you.

Despite how well you prepare for the future, there are events in life, both expected and unexpected, that can influence the monetary health of you and your liked ones. That's a reason permanently insurance. Survivor benefit is generally income-tax-free to recipients. The fatality benefit that's normally income-tax-free to your beneficiaries can assist guarantee your household will have the ability to keep their standard of living, aid them keep their home, or supplement lost income.

Things like prospective tax increases, inflation, monetary emergencies, and preparing for occasions like university, retirement, and even wedding celebrations. Some sorts of life insurance policy can assist with these and other problems also, such as indexed global life insurance coverage, or simply IUL. With IUL, your policy can be a monetary source, since it has the potential to develop worth gradually.

An index may impact your interest attributed, you can not spend or straight participate in an index. Here, your policy tracks, however is not really spent in, an outside market index like the S&P 500 Index.

Best Universal Life Insurance Policy

Charges and expenses may decrease policy values. Since no solitary allotment will be most reliable in all market environments, your financial professional can assist you figure out which combination may fit your economic goals.

That leaves much more in your policy to potentially keep expanding over time. Down the roadway, you can access any type of offered cash value through policy financings or withdrawals.

Talk with your monetary specialist regarding exactly how an indexed universal life insurance policy plan can be part of your total financial method. This material is for basic instructional objectives just. It is not planned to offer fiduciary, tax, or legal suggestions and can not be used to prevent tax obligation fines; neither is it planned to market, advertise, or recommend any type of tax plan or plan.

Group Universal Life Insurance Definition

In the event of a gap, outstanding policy lendings in unwanted of unrecovered expense basis will certainly undergo ordinary earnings tax obligation. If a plan is a modified endowment agreement (MEC), plan financings and withdrawals will be taxable as normal income to the degree there are incomes in the policy.

These indexes are benchmarks only. Indexes can have different constituents and weighting methods. Some indexes have multiple variations that can weight components or may track the effect of dividends in different ways. An index might affect your rate of interest attributed, you can not purchase, straight take part in or get returns payments from any of them via the plan Although an external market index may affect your rate of interest attributed, your policy does not straight participate in any stock or equity or bond investments.

This web content does not apply in the state of New york city. Guarantees are backed by the financial strength and claims-paying capability of Allianz Life insurance policy Business of North America. Products are released by Allianz Life Insurance Policy Company of North America, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. .

Iul Life Insurance Meaning

The info and descriptions consisted of below are not meant to be complete descriptions of all terms, problems and exclusions appropriate to the product or services. The precise insurance policy coverage under any nation Investors insurance policy item is subject to the terms, conditions and exclusions in the real plans as released. Products and solutions explained in this website differ from one state to another and not all items, insurance coverages or solutions are offered in all states.

FOR FINANCIAL PROFESSIONALS We've made to supply you with the best online experience. Your present internet browser might restrict that experience. You might be utilizing an old internet browser that's unsupported, or settings within your web browser that are not suitable with our site. Please conserve on your own some frustration, and update your browser in order to view our site.

Adjustable Premium Life Insurance

Already utilizing an upgraded browser and still having trouble? Please offer us a phone call at for additional help. Your current browser: Detecting ...

Latest Posts

Index Universal Life Insurance Tax Free

New York Life Universal Life Insurance

Gul Policy